Understanding money is a skill everyone needs, yet too many people struggle with the basics. While the financial world is continuously growing and evolving, our collective grasp of it is not.

Alarming statistics from the World Economic Forum reveal a significant number of U.S. and EU adults are financially illiterate.

To measure and improve financial understanding, two researchers developed three deceptively simple questions known in financial circles as the “Big Three.” For two decades, these questions have been asked across dozens of countries, offering insights into global financial literacy—and revealing the gaps we need to close.

The Big Three

1. Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

a. More than $102

b. Exactly $102

c. Less than $102

d. Don’t know

e. Refuse to answer

2. Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account?

a. More than today

b. Exactly the same as today

c. Less than today

d. Don’t know

e. Refuse to answer

3. Do you think the following statement is true or false? Buying a single company’s stock usually provides a safer return than a stock mutual fund.

a. True

b. False

c. Don’t know

d. Refuse to answer

Answering these questions does not require difficult calculations but rather a basic understanding of the language of finance. If you’re a regular reader of Wealth Your Way Insights, you likely know the correct answers are a, c, and b.

These simple yet powerful questions focus on key concepts—interest, inflation, and diversification—that are essential for making informed financial decisions.

According to the research results, however, financial literacy is strikingly low in the U.S. with less than half (43%) of respondents answering all three questions correctly. This is consistent across the globe. Overall, only half or less of the population in most countries is knowledgeable about the basic concepts covered in the “Big Three.”

Stratifying by age group, the young (age 18-29) display the lowest financial literacy, with only one-third able to answer all three questions correctly. This is troubling, as many are making important financial decisions about student loans, managing credit card debt, buying or renting a home, and investing for retirement, all with far-reaching implications.

Are you surprised by the results for the young group? Well, the results for older folks are not much more encouraging. Only half (51%) of the 50-59 age group answered all three correctly, 43% for ages 40-49, and just 39% for ages 30-39.

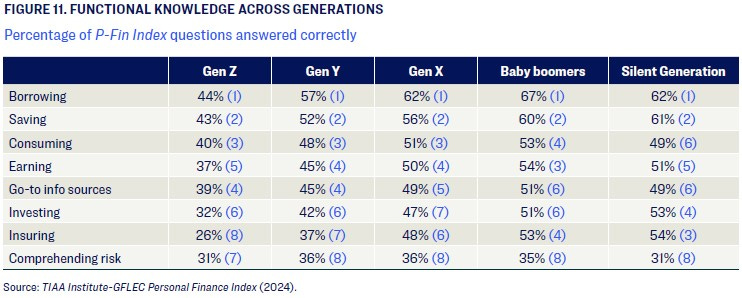

More complex studies (like the P-Fin Index) have confirmed the findings of the Big Three, specifically that low financial literacy is intergenerational, and risk management is what people understand the least.

Extra credit

Although not tested as extensively, the following two questions have been added to the original three and all together are known as…wait for it…the “Big Five.”

4. A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage, but the total interest paid over the life of the loan will be less.

a. True

b. False

c. Don’t know

d. Prefer not to say

5. If interest rates rise, what will typically happen to bond prices?

a. They will rise

b. They will fall

c. They will stay the same

d. There is no relationship between bond prices and the interest rate

e. Don’t know

f. Prefer not to say

Two-thirds of respondents knew the answer to the mortgage question was true. For the bond question, 75% of respondents got it wrong. (Correct answer: b).

Take back your time (employers take notice)

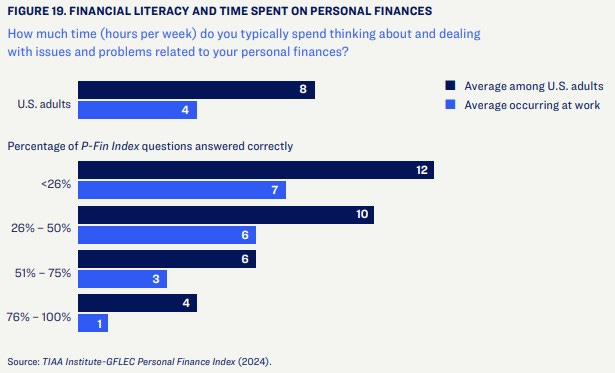

In the U.S., the most financially literate spend 4 hours per week thinking about and dealing with money issues and problems. At the other end of the spectrum, the least financially literate spend 12 hours per week, and 7 of those 12 are spent in the workplace (the equivalent of almost an entire workday every week).

Education is key

Around the globe, the need to improve financial literacy is gaining momentum. Denmark already has mandatory financial education for students aged 13-15, covering budgeting, saving, banking, consumer rights and more, while the UK has incorporated it into its national curriculum.

In the U.S., more than 90% of states incorporate elements of financial literacy into school curricula, but still, only half require students to complete a financial literacy course to graduate.

In 2020, Finland launched a national strategy for financial literacy setting the objective to have the world’s best financial literacy by 2030.

Your financial future starts with small steps today

The good news is you don’t need a national strategy, but you do need a personal one. Have a life plan, be motivated and self-driven. Take an interest in personal finance. You don’t need to be a financial whiz kid, but you should be motivated to learn, and fully aware of the responsibilities that accumulating and managing money require.

Money is deeply influential in almost every aspect of your life, and you likely spend over 2,000 hours each year working to earn more of it. So, ask yourself one last question: Do you spend more time clicking “like” than understanding your finances?

Enjoy today but also make a little time for educating future-you.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to wealth!