Markets have been on a tear—racking up consecutive 20%+ years for only the third time in 75 years. But if history is any guide, outsized returns won’t last forever.

After periods of exceptional growth, markets tend to recalibrate—sometimes gradually, sometimes sharply. The real question isn’t whether the rally will continue, but whether your financial plan is built to withstand whatever comes next.

Some historical perspective

Before we look forward, let’s ground ourselves in some crucial market facts:

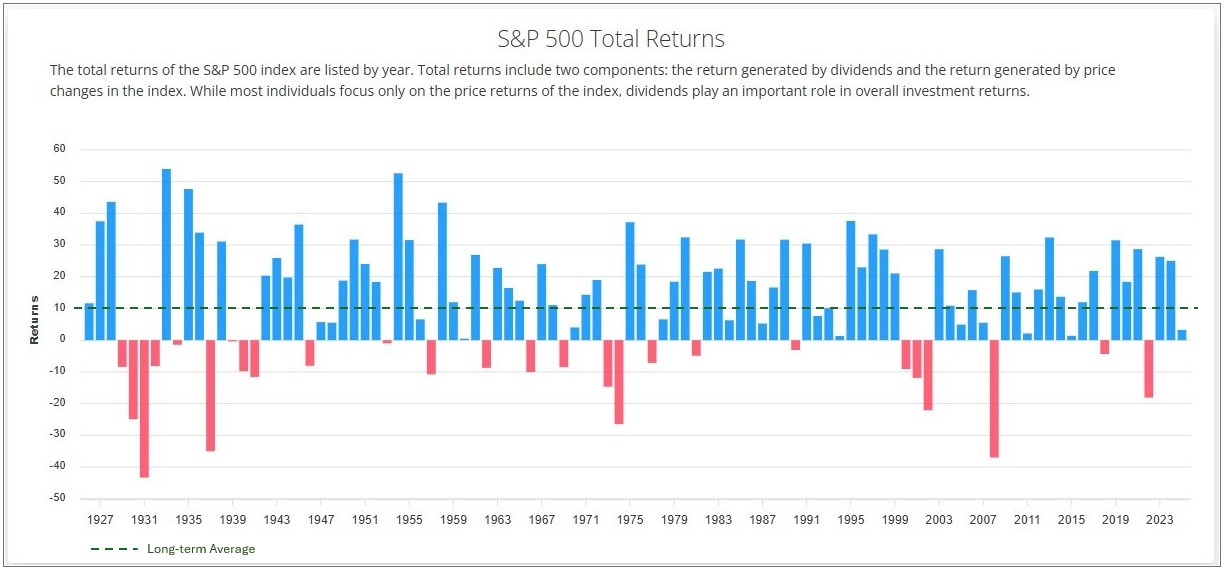

· The S&P 500 has averaged 10% annually since its 1957 inception.

· Individual years rarely deliver the average—only 5 out of the 68 years have landed in the 8-12% range.

· Returns have swung dramatically, from +43% (1958) to -37% (2008). That’s an 80-percentage point spread!

Think of stock market returns like a heart rate monitor. A perfectly steady line would signal trouble—it’s the peaks and valleys that show a healthy, functioning system. Each market cycle, like each heartbeat, has its own rhythm and velocity.

Understanding the 10% average: Not what you might think

The US stock market has a long history of delivering double-digit returns, but the famous 10% average can be misleading. Over nearly a century of market data—going back to 1928—large-cap stocks have indeed delivered a compound annual return of 10.06%.

But here’s what many investors overlook: unless current market returns are approximately equal to the long-term historical average, you shouldn’t expect to receive the average going forward.

In fact, as the current returns move away (whether up or down) from the long-term average, your expectations of future returns should move as well, in the opposite direction! This principle, known as ‘reversion to the mean’ (colloquially: return to normal levels), has been as reliable as gravity in the financial markets.

[Source: Slickcharts]

Recent performance vs. historical norms

Consider this striking contrast:

· From the 2009 market bottom through 2024, the S&P 500 delivered a compounded annual return of 15.2%—a full 50% higher than the long-term average.

· If we assume that the 100-year average remains consistent, simple math suggests this pace is unlikely to continue.

Reversion to the mean pulls averages toward their long-term trend line. But the timing of that reversion is anyone’s guess. Will this 15-year run continue into years 16, 17, etc. or might the reversion begin in 2025?

Investors tend to have short memories. Remember the “Lost Decade” of 2000-2009? Investors endured an annualized return of negative 0.95%, a slow and insidious decline over the ten years.

The analysts weigh in

· Goldman Sachs: Brace yourself—expect just 3% annual returns over the next decade. Their reasoning? The market’s current high valuation starting point. Historically, high valuations lead to below-average future returns (i.e., reversion to the mean).

· A slightly more optimistic view comes from JP Morgan which forecasts US large-cap equities growing at 6.7% over the next 10-15 years, thanks to AI-driven productivity gains.

· Some analysts believe, however, that these long-term forecasts might not be optimistic enough. Yardeni Research thinks “the US economy is in a Roaring 2020s productivity growth boom.” They expect the S&P 500’s average return for the next decade to be “more like 11%.”

Making your portfolio future-ready

How can you prepare for potentially lower returns? Consider these action steps:

1. Review Your Expectations

Are your financial plans based on realistic return assumptions?

Could your portfolio withstand several years of below-average returns?

2. Assess Your Risk Tolerance

If you're nearing retirement, consider reducing portfolio risk.

Ensure your asset allocation matches your current life stage.

3. Build in Safety Margins

Plan for returns below the historical average.

Maintain adequate cash reserves for near-term needs.

As we discussed in Winning the Long Game, being a successful investor requires discipline, patience, and the knowledge that the rocket fuel that propels the market upward will eventually run out.

Rather than constantly chasing a better investment, put some of that attention on being a better investor. You’ll likely grow more wealth and cause less heartache over the long term.

Final thought: are you prepared?

Are you prepared for lower returns or are you letting recent gains lull you into complacency?

The market doesn’t care about the analysts’ or your expectations. Your financial plan needs to withstand all seasons, not just the sunny ones.

Trees don’t grow to the clouds. What soars eventually slows. A little conservatism in your return assumptions won’t just protect your portfolio, it will help you sleep better.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!