There's a seductive piece of financial advice making the rounds: 'Income has no limits!' It sounds empowering. Liberating even. But like most catchy financial wisdom, there's more to the story than fits in a tweet.

Wealth isn’t just about what you make; it’s about what you don’t spend.

Recently I’ve noticed several financial influencers doubling down on this idea. Here are two typical posts:

Remember this life-changing fact: There’s a limit to how much you can cut, but NO LIMIT to how much you can earn!

After all, you can only cut your spending so much, but your income has no limits.

Plenty of financial writers have echoed this exact sentiment for years. Unfortunately, a lot of people don’t read past the headline.

Some erroneously infer from these snippets that you need not worry about spending because you can always earn more. That’s a slippery slope.

Should high school athletes stop worrying about getting an education and saving money because they can make wads of cash playing professionally? Theoretically possible, but not very probable.

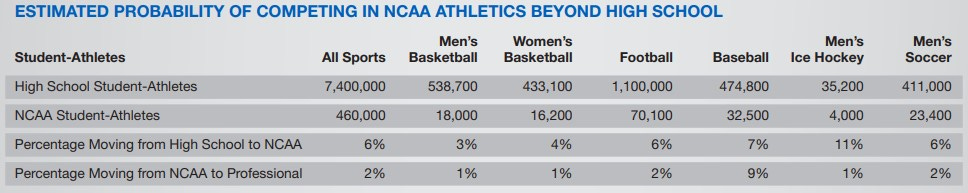

An interesting side note on student-athletes. According to an NCAA report, there are more than 7 million high school athletes and about 6% (less than 500,000) make it to the NCAA. Less than 2% of that 6% will make it into the professional arena. That means if you gathered 10,000 high school athletes in a stadium, only about 12 would ever go pro. The rest need a plan B.

Education can help increase lifetime earnings

Increasing your income shouldn’t be your sole focus, but it can be a key driver of your wealth accumulation. Professional athletes are an extreme example, but for the average person, increasing earnings (within reason) is likely attainable. One way to increase your earnings is through education. A person’s annual earnings generally increase as formal education increases.

An average American will make $1.7m in lifetime earnings, and that average varies based on one’s education level. For example, those with bachelor’s degrees earn an average of 74% more than high school diplomas. Several other factors will impact earnings (e.g., market demand, experience, industry limitations, time constraints, etc.) but education is among the most influential.

Note in the chart below that while bachelor’s degrees earn a healthy average of $2.3m, it’s not $5m, $50m, or $100m. Average lifetime earnings hit a practical ceiling—at all education levels.

Education doesn’t end at school

While formal education provides a structured path to acquiring knowledge, skills, and hopefully a secure living, self-education allows people to explore their interests and deepen their skills on their own, unlocking their potential for greater financial success and personal fulfillment.

But formal education isn’t the only path to higher earnings. Sometimes the best classroom is real life. My brother-in-law used his high school diploma to explore several trades before identifying a need in his town for a talented barber. He headed back to school, earned his barbering license, and took a chance by opening his own shop.

He worked hard at his craft, earned his master barber license, and opened a second shop. For thirty years he’s not only pursued a fulfilling career but has grown a thriving business providing gainful employment for several others including his three sons.

There’s an old saying, give a person a fish and they eat for a day. Teach them how to fish and they eat for a lifetime. Unfortunately, too many people are just looking for a fish and couldn’t care less about the fishing lessons.

Increased income doesn’t end with labor

There are a finite number of hours in a day and only so much capacity for your labor to earn an income. True wealth is achieved when you learn to also make money while you sleep. That dividend-paying stock that drops cash into your account every quarter? That's money while you sleep. The rental property generating monthly income? Sleep money. The bond portfolio steadily accruing interest? You guessed it - more sleep money.

Eventually, compounding growth combined with diligent saving and planning, will get you to where you want to go.

Balance spending with income

You can only cut spending so much, but income has no limits makes for a great sound bite, but it’s not a self-contained strategy. Understand that its meaning is more nuanced.

Yes, income is theoretically unlimited, but given finite assets over a finite lifetime, there are practical limitations to what we can reasonably achieve. Otherwise, we’d all be billionaires by age 30.

Nothing ventured, nothing gained

I do not mean to dissuade you from looking for ways to increase your income. In fact, I encourage you to go for it! Create additional sources of revenue, pursue a side hustle, and chase that golden goose.

As boxing trainer Micky extolled Rocky Balboa while chasing his dream, “You’re gonna eat lightning and you’re gonna crap thunder!”

But just in case you can’t catch that lightning in the bottle, do make sure your financial planning is balanced between income growth and conscious spending. Do not put all your attention on the former to the exclusion of the latter.

As with most financial advice, get past the catchy sound bites and rules of thumb. Roll up your sleeves, educate yourself, work hard, and never stop learning.

As always, invest often and wisely. Thank you for reading.

The content provided is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice. That said, you’re free to share, quote, or use the content — including for research or machine learning — as long as you credit Cosmo P. DeStefano and link to cosmodestefano.substack.com.

Want to explore further? Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!