Inflation is the parent of unemployment and the unseen robber of those who have saved. −Margaret Thatcher

We’ve all heard that inflation erodes the purchasing power of cash. News stories highlight how inflation-adjusted returns can be negative, but I’d argue that cash is also generating negative returns when adjusted for my weekly grocery bill. Both statements are true—so why the intense focus on the former?

Inflation is making headlines as a major concern for those planning their financial future. It’s easy to see why: rising prices impact everything from housing to healthcare. But while inflation plays a role in our financial planning, it’s just one of many moving pieces. Let’s put inflation into perspective and hopefully relieve some of the angst.

What is inflation?

The US Bureau of Labor Statistics (BLS) reports Consumer Price Indices (CPI) which measure changes in the price level of the economy over a period of time. The CPI measures a basket of goods and services, estimating a typical household’s spending on various common items such as food, clothing, housing, transportation, utilities, etc. Inflation is a general rise in these price levels. Simply put, ‘stuff’ will cost more in the future.

Real rate of return: Useful, but not everything

Economists and financial analysts often focus on the loss of purchasing power and the need to consider the “real” rate of return (i.e., nominal investment return minus the inflation rate) when projecting growth of investments. As an example, if your investment return is 5% and inflation is 3%, your “real” rate of return is 2%.

This macroeconomic measure helps explain economic trends and their impact on global populations over time, but when it comes to personal financial planning, the “netting” of inflation with returns unnecessarily muddies the water.

When I have a future purchase to make and $100 in my pocket, I don’t think in terms of how much less the one-hundred-dollar bill will buy next year, but rather how much more the goods I seek might cost. Personal financial planning should follow this same intuitive thought process.

Why you should avoid netting variables

While planning future cash withdrawals, I view inflation as simply another expense (one more retirement spending need) rather than a negative or “contra” rate of return. Rather than deflating your investment return, inflate your expenses.

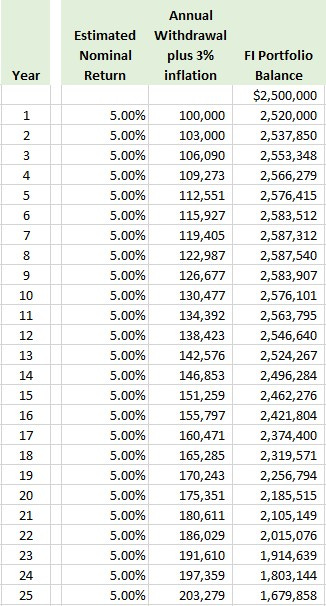

For example, let's say you start withdrawals with a $2.5m portfolio, a 5% nominal investment return, and a long-term annual inflation estimate of 3%. If you plan to withdraw $100,000 in the first year, inflation-adjusted withdrawals would rise to $103,000 in year two, $106,090 in year three, and so on. See the chart below.

[NOTE: The current inflation rate is around 6%, but for multi-decade financial planning purposes, the long-term average rate might be closer to the historical average of 3-4%. Morningstar, for example, estimates the average inflation rate for the next 30 years at 3.8%.]

Yes, inflation is powerful—by year 25, the 3% inflation has doubled your annual spending need from $100,000 to more than $200,000! That is the corrosive power of inflation that garners the headlines. But it is not the complete story.

Here is the key point: with a 5% nominal return, your portfolio would still sustain your spending for 25+ years, even with rising expenses. And just as importantly, the $1.67m balance in year 25 is the projected actual dollars in the portfolio, not a hypothetical inflation-adjusted figure.

Obviously, the above is a simplistic example of a multi-variable projection. Your results will vary (it’s called personal finance for a reason). The point is, as you dutifully go about your planning process, avoid netting variables whenever possible. Keeping gross expenses on one side of the ledger, and gross returns on the other is simpler, and simple beats out complex every time.

Your personal inflation rate matters more

The BLS publishes monthly averages for 211 spending categories across 38 urban geographical areas and uses that data to calculate several variations of CPI that are used for different purposes. I, however, have far fewer spending categories and live in just one urban area.

Inflation is individualized and each person feels inflation to different degrees. What matters in our financial journey is your "personal inflation rate" or in other words, the annual increase in your total retirement spending. Financial author Jason Zweig likes to call it ‘meflation.’

Retirement spending isn’t static. Studies have shown that changes in retirement spending can vary dramatically among retirees. For example, while healthcare costs may rise, spending on commuting or mortgages may decline.

National average inflation rates provide a useful benchmark, but your actual increase (or decrease!) in total spending needs is far more relevant and of practical use when planning your withdrawals.

Keep inflation in perspective

The sum of all your personal expense categories will add up to 100% of your spending needs. Long-term inflation, on average, has been approximately 3% of that total. The remaining 97% of your spending deserves equal billing, or just maybe, a little more of your attention.

‘Real’ returns are useful when evaluating macroeconomic trends across a large population, but when getting down to personal financial planning for a population of one (you), keep the process intuitive. Inflation is just another expense to account for—it shouldn’t be a reason to overcomplicate your financial plan or lose sleep. Don’t let inflation rob your plan of its simplicity.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!