There are no shortcuts to anyplace worth going. —Beverly Sills

In our hectic lives, everyone likes a quick answer. How about this one: When you can live off 4% of your portfolio annually you are financially independent. Short and sweet. Seems like a simple enough shortcut to follow, but first, recognize it as such—a shortcut. And know this, when blindly accepted as golden rules, shortcuts can be dangerous to your financial and emotional well-being.

When planning for the withdrawal stage, several variables impact your plan: rate of return, number of years in the plan, asset allocation, sequence of returns, etc. Some of these variables are out of your control. The single largest variable, however, is likely the dollar amount of your annual withdrawals, and this variable is completely within your control. Hence the wide popularity of the 4% Rule.

If you look past the one-line of advice, however, most proponents of the 4% Rule will also point out that while it may be a valid starting point, it is not a set it and forget it strategy.

A progression of thinking

Let’s start with a holistic view of withdrawal strategies. My experience shows that there are four levels in the progression of thinking about your Financial Independence (FI) “number” and withdrawals from that portfolio:

Level One: Financial novices throw out numbers off the top of their heads without any real data to back them up. I’ve heard guesses at the presumed FI number in the range of $500,000 to $25 million. That’s a big range! And that range tells us nothing about how much a person could annually withdraw. Fun to banter around with friends, but not a lot of practical guidance at this level.

Level Two: Some advisors suggest that you use your pre-FI income to estimate your targeted FI spending needs. That is, multiply your salary by some factor (often 70%-85%) to estimate what you will need in annual FI cash flow. This implies that your spending is directly tied to your historical level of income. If you are living paycheck to paycheck, this estimate may be somewhat reliable. For diligent FI enthusiasts who annually save increasing amounts of their income, this method could significantly overstate FI cash flow needs.

Level Three: You gain more focus and clarity by estimating spending needs based on your projected future expenses rather than a percentage of historical income. You then take your annual cash flow need and multiply it by 25 to get to your targeted FI number (this is effectively getting at the 4% Rule discussed later).

Level Four: FI enthusiasts and advisors work past these “rules of thumb” and averages, and focus on projecting a personalized withdrawal dollar amount based on your spending needs. Resulting in a personal withdrawal rate that could be higher or lower than the shortcut average 4% rate.

You cannot get to 100% certainty of never running out of money (remember, no one can predict the future with complete accuracy), but these four levels coincide with increasing confidence levels. If you are the freewheeling fly by the seat of your pants type, pick a number at level one, and never worry about it again! Since you are reading this article, I would suggest you are already past level one and looking to refine your number and gain more confidence in your personal withdrawal strategy.

Origin of the 4% rule

This concept was first introduced by financial advisor, Bill Bengen in 1994. Mr. Bengen has been clear in pointing out that his research is based on a worst-case scenario using a very specific set of assumptions including a targeted asset allocation of 50% stocks and 50% intermediate-term US government bonds; historical market results; and a fixed 30-year retirement period.

In short, you withdraw 4% of your FI Portfolio in your initial year. In subsequent years, you increase the dollar amount of your withdrawal to account for inflation. In theory, by following this principle, you should have a high probability of your annual withdrawals lasting 30 years.

For example, let’s say you have $1 million in your FI Portfolio at the beginning of your withdrawal stage. In year one, you could withdraw $40,000. If inflation (i.e., the cost of living) rises 3% that year, then in year two, you withdraw $41,200 ($40,000 plus 3%) and so on for 30 years.

Over the years, however, the details have faded away and the concept has come to be known as the safe spending rate, or simply, the 4% Rule.

There is no one-size-fits-all

Twenty-five years after first publishing his findings, Bengen discussed the over-simplified interpretation of the ‘4% Rule’ that has found a wide audience. Bengen noted that 4% is based on empirical research but it’s not (and never has been) an unassailable truth. There is no one-size-fits-all and your personal withdrawal rate ‘could be anything.’

If you are early in your wealth accumulation stage with decades to go, being familiar with the “4% Rule” can give you a big picture view of a distant future. That is, for each $1 million in your FI Portfolio, you may be able to generate roughly $40,000 of annual cash flow. It’s a helpful shortcut but only for a very high-level estimation.

As the winds of change blow, put up a sail, not a wall

The point is, no amount of historical research and back-testing can give you an absolute withdrawal rate going forward. Rather than a rule or goalpost, use 4% as a guidepost in your financial planning and annual updates. Adjust for your personal circumstances, accordingly.

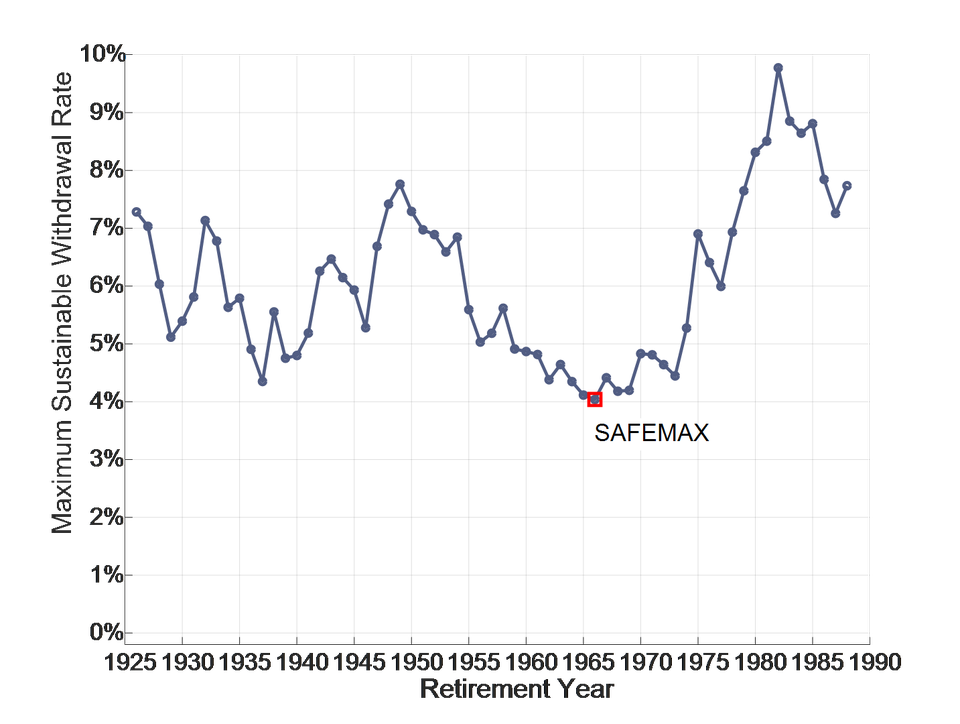

Below is a chart of the maximum sustainable withdrawal rates (based on Bengen’s research) prepared by Wade Pfau in 2018. As you can see, the so-called SAFEMAX (a term Bengen used to describe the highest sustainable withdrawal rate for the worst-case scenario in the time period covered) is approx. 4%.

SAFEMAX: Maximum Sustainable Withdrawal Rates For 50/50 Asset Allocation, 30-Year Retirement, Inflation Adjustments Using SBBI Data, 1926–2017, S&P 500 and Intermediate-Term Government Bonds (Source: Forbes)

But look at the variability of results depending on the year of retirement. The range is approximately 4% for a retiree in 1966 to over 9% for a retiree in 1982.

So, rather than thinking of 4% as the target, think of it as being on the lower end of a range—a range of possible outcomes. With the use of probabilities, you can then calibrate your projections knowing that moving down towards 4% (or below) is conservative and moving above 4% is potentially aggressive but not out of the question.

Let 4% inform your plan, not be your plan

4% might work for the average person, but no one individual is the ‘average person.’ Everyone is unique; and while 4% might work in a hypothetical example with one set of specific variables, change one or more of those variables, and all bets are off. You need to assess your personal ‘safe’ withdrawal rate.

The key is to not have a rigid withdrawal plan, but a flexible and personalized strategy. For example, developing a plan that contemplates variable annual withdrawals providing flexibility to take less when market valuations are down (e.g., temporarily lowering your vacation spending, or dining out expenses), and to take more when valuations are higher.

Being flexible can increase the likelihood that your money will last as long as you do.

PCR: Plan, Course-correct, Repeat.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to wealth!